Can Random Walk Predict Cryptocurrency Prices? A Look at Bitcoin's Past and Future

Can the concept of random walks combined with past data provide answers about the future of cryptocurrency prices? This post explores Bitcoin's past growth and analyzes a simulation of future returns based on a specific coefficient of change. Find out what the simulation reveals about potential returns and the crucial prerequisites that must be met for the predictions to hold true.

The concept of a random walk is familiar to those who have the misfortune, or perhaps fortune, of dealing with artificial intelligence. Those in the know are aware that today (as of February 2022), it is highly unlikely that any AI model can beat the naive model. And what is the naive model? It's the "prediction" of an algorithm that the next value will be the same as the previous one. This is how embryonic AI currently is with regard to predicting stock prices.

Therefore, under certain circumstances, a random walk, i.e. the random fluctuation of prices, can provide answers about the future if combined with the past. So what are these circumstances? Let's take a look...

Requirement 1: First, let's establish some facts about Bitcoin. In July 2010, the value of Bitcoin was only one cent of a dollar. However, ten years later, its value had skyrocketed to around $10,000, with a peak high of $20,000 at the end of 2017. For the purposes of our analysis, we'll focus on the closing value of $10,000 and ignore the peak high of $20,000.

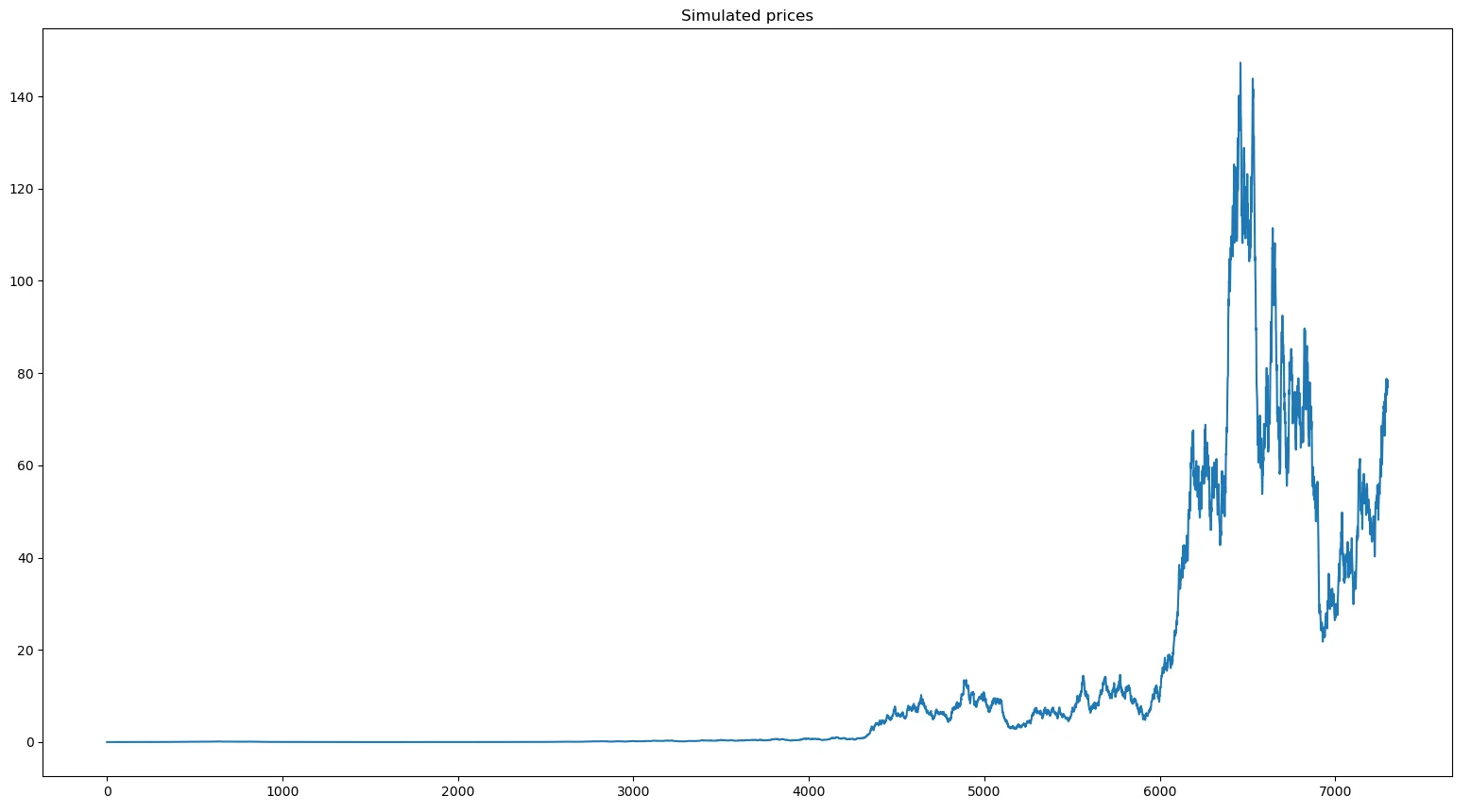

Next, we'll examine the daily fluctuation rate, which is determined by a coefficient of change, denoted as "r". This coefficient regulates the daily price fluctuations within a certain range. For instance, if r = 5%, the daily fluctuation cannot exceed +5% or -5%. A higher coefficient results in greater price volatility, which can lead to more extreme prices. However, we'll impose one condition: in our simulation, no price can exceed that of Bitcoin. Essentially, we'll treat Bitcoin as a ceiling that cannot be surpassed by any other cryptocurrency.

To meet this condition, we ran a simulation twenty times, with 10,000 cryptocurrencies each, and varied the coefficient of change from 1% to 10%, starting at a value of one cent. After completing the simulations, we found that the cryptocurrency with the highest return rate (Bitcoin) achieved the coveted average value of $10,000, ten years later, with a coefficient of change of 4.1%. This allowed us to determine the range of fluctuations that led Bitcoin to its frenzied growth during the decade from 2010 to 2020.

Now that we have found the exact coefficient that determined the performance of Bitcoin, we move on to the second requirement.

Requirement 2: The coefficient "r" that guided Bitcoin during its 10-year maturation period will continue to do so in the future.

This requirement generates much discussion because Bitcoin may not exist in 10 years or may have returned to being worth only one cent, or there may not even be a planet with people on it capable of using it. However, the phrase "let's assume that" is used here.

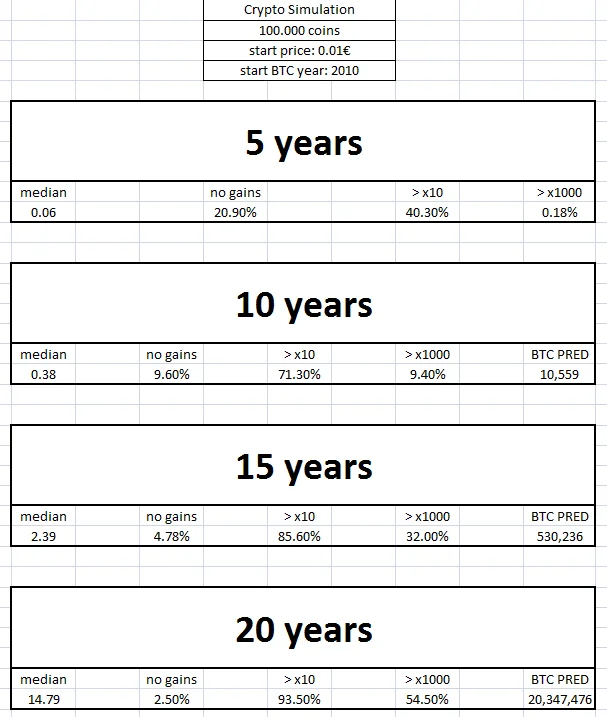

For the second requirement, I took the golden coefficient "r" (4.1%) that is theoretically in effect since Bitcoin is currently a reality, and ran a simulation of 100,000 coins with an initial value of one cent for 5, 10, 15, and 20 years in the future, based on the year 2010.

The results are shown in the table below. The column explanations are as follows:

median: The median is the middle value when the sorted list of crypto values is arranged in ascending order. For example, if we take a look at a 10-year period, the median is 0.38, which means that if you randomly select a cryptocurrency today, there is a good chance that its value will increase by 38 times in 10 years.

no_gains: This refers to the probability of not having any gains at all, where the value of the cryptocurrency remains the same or becomes zero.

>x10 ή >x1000: This refers to the probability of multiplying your investment by 10 or 1000 times in the respective years.

BTC PRED: This is a prediction for Bitcoin. The model's prediction for the years 2025 and 2030 refers to a 15-year and 20-year period, respectively.

Some of the simulation's elements are truly impressive, such as the likelihood of your initial capital being multiplied by 1000 in 20 years with a 54.5% probability. Even more impressive is the fact that a digital currency with no intrinsic value can go from $0.01 to $10,000 in just 10 years, so it's not surprising that it could reach $530,000 in 2025.

This article concludes with the third and most crucial prerequisite of all: cryptocurrencies remaining mainstream and not being replaced by something else, or not being globally banned. If any of these things happen, the above simulation becomes irrelevant. Bitcoin's popularity and dynamic is what brought it to where it is today. If anything changes, or if restrictive laws are imposed globally, Bitcoin and cryptocurrencies in general will weaken and eventually disappear. At present, there is no sign of such a thing happening, but data changes rapidly, so the only certain things are death and taxes.

The xlsx file with the entire simulation can be downloaded for free here for anyone interested.

Jan 2023 Update: Almost a year after running the simulation above, much has happened on planet Earth, from wars and destruction to the universal ban on cryptocurrencies in major markets like China and the reordering of the global status quo. Bitcoin is still here, alive but wounded. The r factor of the 2010-2020 decade seems to have abandoned it for good, and it is unlikely to reach the simulation's prices. By the end of 2025 and '30, we will be here to observe the current prices, readjust coefficients, and draw our conclusions.

It is important to note that this article does not provide investment advice for the purchase or sale of cryptocurrencies or any other assets. It is a result of scientific research and study. For any asset purchase, it is recommended to consult certified professionals.